Filed Pursuant to Rule 424(b)(3)

Registration No. 333-261137

BIRD GLOBAL, INC.

150,634,784 SHARES OF CLASS A COMMON STOCK

6,596,000 WARRANTS TO PURCHASE SHARES OF CLASS A COMMON STOCK

12,874,972 SHARES OF CLASS A COMMON STOCK UNDERLYING WARRANTS

This prospectus relates to the resale from time to time of (i) an aggregate of 148,409,784 shares of Class A common stock, par value $0.0001 per share (the “Class A common stock”), of Bird Global, Inc., a Delaware corporation (“Bird Global”), issued or issuable in connection with the Business Combination (as defined below), by the selling securityholders named in this prospectus (each a “selling securityholder” and, collectively, the “selling securityholders”), (ii) 6,596,000 warrants to purchase Class A common stock at an exercise price of $11.50 per share (the “Sponsor Warrants,” which includes 6,550,000 warrants that are “private placement warrants” under the Warrant Agreement (as defined below) (the “private placement warrants”) by certain of the selling securityholders, and (iii) the issuance by us and resale of up to 2,225,000 shares of Class A common stock reserved for issuance upon the settlement of stock-based awards. This prospectus also relates to the issuance by us of up to 12,874,972 shares of Class A common stock upon the exercise of outstanding private placement warrants and public warrants (the “public warrants” and, together with the private placement warrants, the “warrants”).

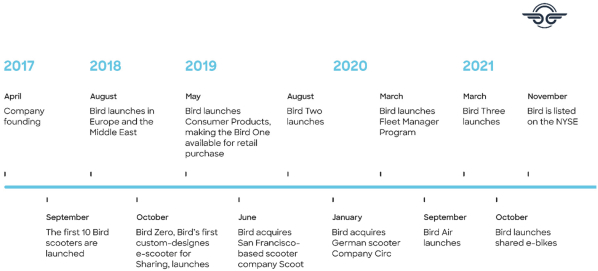

On November 4, 2021 (the “Acquisition Closing Date”), we consummated the transactions contemplated by that certain Business Combination Agreement, dated as of May 11, 2021, by and among Switchback II Corporation, a Cayman Islands exempted company (“Switchback”), Maverick Merger Sub Inc., a Delaware corporation and a direct wholly owned subsidiary of Switchback (“Merger Sub”), Bird Rides, Inc., a Delaware corporation (“Bird”), and Bird Global (as amended from time to time, the “Business Combination Agreement”), which provided for: (1) the merger on November 3, 2021 of Switchback with and into Bird Global, with Bird Global surviving as a publicly traded entity and the sole owner of Merger Sub (the “Domestication Merger”); (2) the merger on the Acquisition Closing Date of Merger Sub with and into Bird, with Bird continuing as the surviving entity and a wholly owned subsidiary of Bird Global (the “Acquisition Merger”); and (3) the other transactions contemplated therein (collectively, the “Business Combination”).

We are registering the resale of shares of Class A common stock and Sponsor Warrants as required by (i) that certain Amended and Restated Registration Rights Agreement, dated as of the Acquisition Closing Date (as amended from time to time, the “Registration Rights Agreement”), by and among us, NGP Switchback II, LLC, a Delaware limited liability company (the “Sponsor”), certain affiliates of Switchback prior to the Acquisition Merger (together with the Sponsor, the “Switchback Holders”), and certain holders of Bird securities prior to the Acquisition Merger (the “Bird Holders”), and (ii) those certain subscription agreements, each dated May 11, 2021 (as amended from time to time, the “Subscription Agreements”), entered into by and between Switchback and certain qualified institutional buyers and accredited investors (the “PIPE Investors”) that purchased shares of Class A common stock in private placements consummated in connection with the Business Combination (the “PIPE Financing”). We are registering the issuance of shares of Class A common stock upon exercise of warrants as required by that certain Warrant Agreement, dated as of January 7, 2021, between Switchback and Continental Stock Transfer & Trust Company, as warrant agent (the “Warrant Agreement”).

We are also registering the issuance and resale of shares of Class A common stock reserved for issuance upon the settlement of stock-based awards held by certain of our current and former service providers.

We will receive the proceeds from any exercise of the warrants or stock options for cash, but not from the resale of any shares of Class A common stock or Sponsor Warrants by the selling securityholders covered by this prospectus.

We will bear all costs, expenses, and fees in connection with the registration of the shares of Class A common stock and Sponsor Warrants. The selling stockholders will bear all commissions and discounts, if any, attributable to their respective sales of the shares of Class A common stock and Sponsor Warrants.

Our shares of Class A common stock are listed on The New York Stock Exchange (the “NYSE”) under the symbol “BRDS.” On November 26, 2021, the closing sale price of our Class A common stock was $6.74 per share. Our public warrants are listed on the NYSE under the symbol “BRDS WS.” On November 26, 2021, the closing sale price of our public warrants was $1.37 per warrant.

We are an “emerging growth company” and a “smaller reporting company” under the federal securities laws and will be subject to reduced disclosure and public reporting requirements. See “Summary—Implications of Being an Emerging Growth Company and a Smaller Reporting Company.”

Investing in shares of our Class A common stock or warrants involves risks that are described in the “Risk Factors” section beginning on page 14 of this prospectus.

Neither the U.S. Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of the securities to be issued under this prospectus or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is November 29, 2021.