UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | | | | |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

Bird Global, Inc.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| | | | | | | | |

| | |

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | |

May 3, 2023

To Our Stockholders:

You are cordially invited to attend a Special Meeting of Stockholders (the “Special Meeting”) of Bird Global, Inc. (the “Company,” “we” or “us”) at 1:00 p.m., Eastern Time, on Thursday, May 18, 2023. The Special Meeting will be a completely virtual meeting at www.virtualshareholdermeeting.com/BRDS2023SM, which will be conducted via live webcast.

The Notice of Special Meeting of Stockholders and Proxy Statement on the following pages describe the matters to be presented at the Special Meeting. Please see the section called “Who can attend the Special Meeting?” on page 4 of the proxy statement for more information about how to attend the Special Meeting online.

Whether or not you attend the Special Meeting online, it is important that your shares be represented and voted at the Special Meeting. Therefore, I urge you to promptly vote and submit your proxy by phone, via the Internet, or by signing, dating and returning the enclosed proxy card in the enclosed return envelope, which requires no postage if mailed in the United States. Instructions regarding how you can vote are contained on the proxy card. If you decide to attend the Special Meeting, you will be able to vote online, even if you have previously submitted your proxy.

Thank you for your support.

Sincerely,

Shane Torchiana

Chief Executive Officer

Table of Contents

BIRD GLOBAL, INC.

392 NE 191st Street #20388

Miami, Florida 33179

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD THURSDAY, MAY 18, 2023

The Special Meeting of Stockholders (the “Special Meeting”) of Bird Global, Inc., a Delaware corporation (the “Company,” “we”, “our” or “us”), will be held at 1:00 p.m., Eastern Time, on Thursday, May 18, 2023. The Special Meeting will be a completely virtual meeting, which will be conducted via live webcast. You will be able to attend the Special Meeting online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/BRDS2023SM and entering your 16-digit control number included on your proxy card or on the instructions that accompanied your proxy materials. The Special Meeting will be held for the following purposes:

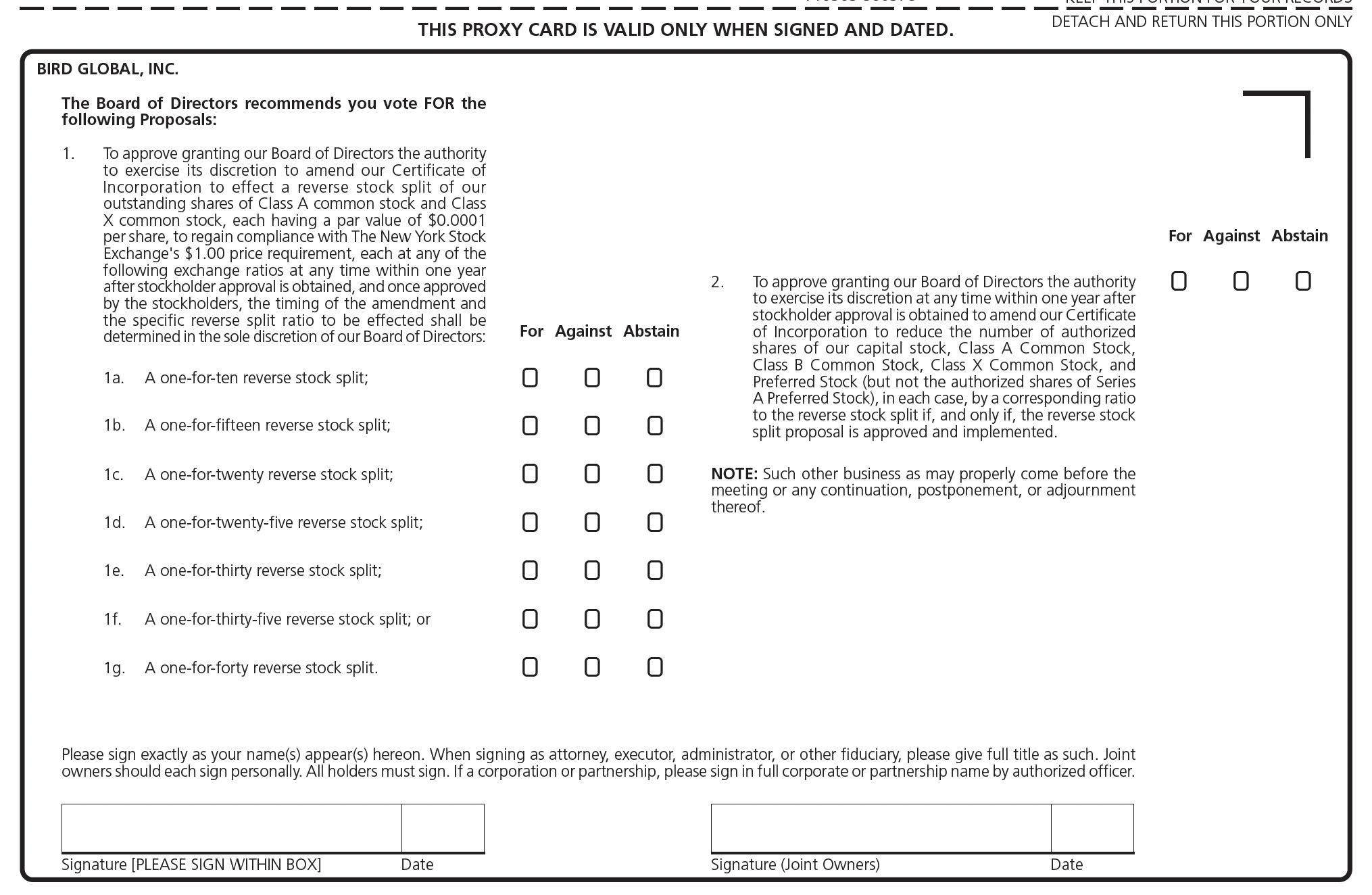

•To approve granting our Board of Directors the authority to exercise its discretion to amend our Certificate of Incorporation to effect a reverse stock split of our outstanding shares of Class A common stock and Class X common stock, each having a par value of $0.0001 per share, to regain compliance with The New York Stock Exchange's $1.00 price requirement, each at any of the following exchange ratios at any time within one year after stockholder approval is obtained, and once approved by the stockholders, the timing of the amendment and the specific reverse split ratio to be effected shall be determined in the sole discretion of our Board of Directors:

A. A one-for-ten reverse stock split;

B. A one-for-fifteen reverse stock split;

C. A one-for-twenty reverse stock split;

D. A one-for-twenty-five reverse stock split;

E. A one-for-thirty reverse stock split;

F. A one-for-thirty-five reverse stock split; or

G. A one-for-forty reverse stock split.

•To approve granting our Board of Directors the authority to exercise its discretion at any time within one year after stockholder approval is obtained to amend our Certificate of Incorporation to reduce the number of authorized shares of our capital stock, Class A Common Stock, Class B Common Stock, Class X Common Stock, and Preferred Stock (but not the authorized shares of Series A Preferred Stock), in each case, by a corresponding ratio to the reverse stock split if, and only if, the reverse stock split proposal is approved and implemented.

•To transact such other business as may properly come before the Special Meeting or any continuation, postponement, or adjournment of the Special Meeting.

Holders of record of our Class A common stock and Class X common stock as of the close of business on May 1, 2023 are entitled to notice of and to vote at the Special Meeting, or any continuation, postponement, or adjournment of the Special Meeting, and the holder of record of our Series A preferred stock as of the close of business on May 1, 2023 is entitled to notice of and to vote together with our Class A common stock and Class X common stock on Proposal 2 at the Special Meeting. A complete list of all such stockholders will be open to the examination of any stockholder for a period of ten days prior to the Special Meeting for a purpose germane to the meeting by sending an email to Investor Relations, at ir@bird.co, stating the purpose of the request and providing proof of ownership of Company stock. A list of these stockholders will also be available on the bottom of your screen during the Special Meeting after entering the 16-digit control number included on your proxy card or on the instructions that accompanied your proxy materials. The Special Meeting may be continued, postponed, or adjourned from time to time without notice other than by announcement at the Special Meeting.

It is important that your shares be represented regardless of the number of shares you may hold. Whether or not you plan to attend the Special Meeting online, we urge you to vote your shares via the toll-free telephone number or over the Internet, as described in the enclosed materials, or by signing, dating and mailing the enclosed proxy card in the enclosed return envelope. Promptly voting your shares will ensure the presence of a quorum at the Special Meeting and will save us the expense of further solicitation. Submitting your proxy now will not prevent you from voting your shares at the Special Meeting if you desire to do so, as your proxy is revocable at your option.

By Order of the Board of Directors:

Courtney Schoch

Sr. Corporate Counsel and Corporate Secretary

Miami, Florida

May 3, 2023

BIRD GLOBAL, INC.

392 NE 191st Street #20388

Miami, Florida 33179

This proxy statement (the “Proxy Statement”) is furnished in connection with the solicitation by the Board of Directors (the “Board”) of Bird Global, Inc., a Delaware corporation (the “Company,” “we” or “us”), of proxies to be voted at our Special Meeting of Stockholders (the “Special Meeting”) to be held on Thursday, May 18, 2023, at 1:00 p.m., Eastern Time, and at any continuation, postponement, or adjournment of the Special Meeting. The Special Meeting will be a completely virtual meeting, which will be conducted via live webcast. You will be able to attend the Special Meeting online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/BRDS2023SM and entering your 16-digit control number included on your proxy card or on the instructions that accompanied your proxy materials.

Holders of record of shares of our Class A common stock, $0.0001 par value per share (the “Class A Common Stock”), and our Class X common stock, $0.0001 par value per share (the “Class X Common Stock,” and together with our Class A Common Stock, the “Common Stock”), as of the close of business on May 1, 2023 (the “Record Date”), will be entitled to notice of and to vote at the Special Meeting and any continuation, postponement, or adjournment of the Special Meeting. As of the Record Date, there were 288,959,266 shares of Class A Common Stock, which includes restricted shares of our Class A Common Stock held by certain equity award holders (the “Restricted Earnout Shares”) under the Bird Global, Inc. 2021 Equity Incentive Plan (the “2021 Plan”), as well as restricted shares of Class A Common Stock issued upon early exercises of options, and 34,534,930 shares of Class X Common Stock outstanding and entitled to vote at the Special Meeting. Each share of Class A Common Stock is entitled to one vote and each share of Class X Common Stock is entitled to 20 votes on any matter presented to stockholders at the Special Meeting. The holders of Class A Common Stock and Class X Common Stock will vote together as a single class on all matters presented to stockholders at the Special Meeting. As of the Record Date, there also was one share of Series A preferred stock, $0.0001 par value per share (the “Series A Preferred Stock”), outstanding. . The holder of record of our Series A Preferred Stock as of the Record Date is not entitled to notice of or to vote on Proposal 1, but is entitled to notice of and to vote together with the holders of Class A Common Stock and Class X Common Stock on Proposal 2 at the Special Meeting.

These proxy solicitation materials were first sent or given on or about May 4, 2023 to all stockholders entitled to vote at the Special Meeting.

Background

The Company was incorporated under the laws of the State of Delaware on May 4, 2021 as a wholly owned subsidiary of Bird Rides, Inc. (“Bird Rides”) for the purpose of entering into the Business Combination Agreement, dated as of May 11, 2021 (as amended, the “Business Combination Agreement”), by and among Switchback II Corporation, a Cayman Islands exempted company (“Switchback”), Maverick Merger Sub Inc., a Delaware corporation and a direct wholly owned subsidiary of Switchback (“Merger Sub”), Bird Rides and the Company. Switchback was formed on October 7, 2020 for the purpose of effecting a merger, amalgamation, share exchange, asset acquisition, share purchase, reorganization, or similar business combination involving Switchback and one or more businesses. On November 3, 2021, the Company merged with and into Switchback, with the Company continuing as the surviving entity. On November 4, 2021, Merger Sub merged with and into Bird Rides (the “Acquisition Merger”), with Bird Rides continuing as the surviving entity and as a wholly owned subsidiary of the Company.

Unless otherwise indicated, in this proxy statement, the “Company”, “Bird”, “we”, “us”, and “our” refer to Bird Global, Inc. following the transactions contemplated by the Business Combination Agreement (the “Business Combination”).

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SPECIAL MEETING TO BE HELD ON THURSDAY, MAY 18, 2023

This Notice of Special Meeting and the Proxy Statement are available at www.virtualshareholdermeeting.com/BRDS2023SM.

Proposals

At the Special Meeting, our stockholders will be asked:

•To approve granting our Board of Directors the authority to exercise its discretion to amend our Certificate of Incorporation to effect a reverse stock split of our outstanding shares of Class A common stock and Class X common stock, each having a par value of $0.0001 per share, to regain compliance with The New York Stock Exchange's $1.00 price requirement, each at any of the following exchange ratios at any time within one year after stockholder approval is obtained, and once approved by the stockholders, the timing of the amendment and the specific reverse split ratio to be effected shall be determined in the sole discretion of our Board of Directors:

A. A one-for-ten reverse stock split;

B. A one-for-fifteen reverse stock split;

C. A one-for-twenty reverse stock split;

D. A one-for-twenty-five reverse stock split;

E. A one-for-thirty reverse stock split;

F. A one-for-thirty-five reverse stock split; or

G. A one-for-forty reverse stock split.

•To approve granting our Board of Directors the authority to exercise its discretion at any time within one year after stockholder approval is obtained to amend our Certificate of Incorporation to reduce the number of authorized shares of our capital stock, Class A Common Stock, Class B Common Stock, Class X Common Stock, and Preferred Stock (but not the authorized shares of Series A Preferred Stock), in each case, by a corresponding ratio to the reverse stock split if, and only if, the reverse stock split proposal is approved and implemented

•To transact such other business as may properly come before the Special Meeting or any continuation, postponement, or adjournment of the Special Meeting.

Recommendations of the Board

The Board recommends that you vote your shares as indicated below. If you return a properly completed proxy card, or vote your shares by telephone or Internet, your shares will be voted on your behalf as you direct. If not otherwise specified, the shares represented by the proxies will be voted, and the Board recommends that you vote:

•FOR granting our Board of Directors the authority to exercise its discretion to amend our Certificate of Incorporation to effect a reverse stock split of our outstanding shares of Class A common stock and Class X common stock, each having a par value of $0.0001 per share, to regain compliance with The New York Stock Exchange's $1.00 price requirement, each at any of the following exchange ratios at any time within one year after stockholder approval is obtained, and once approved by the stockholders, the timing of the amendment and the specific reverse split ratio to be effected shall be determined in the sole discretion of our Board of Directors:

A. A one-for-ten reverse stock split;

B. A one-for-fifteen reverse stock split;

C. A one-for-twenty reverse stock split;

D. A one-for-twenty-five reverse stock split;

E. A one-for-thirty reverse stock split;

F. A one-for-thirty-five reverse stock split; or

G. A one-for-forty reverse stock split.

•FOR granting our Board of Directors the authority to exercise its discretion at any time within one year after stockholder approval is obtained to amend our Certificate of Incorporation to reduce the number of authorized shares of our capital stock, Class A Common Stock, Class B Common Stock, Class X Common Stock, and Preferred Stock (but not the authorized shares of Series A Preferred Stock), in each case, by a corresponding ratio to the reverse stock split if, and only if, the reverse stock split proposal is approved and implemented.

We know of no other business to be presented at the Special Meeting. If any other matter properly comes before the stockholders for a vote at the Special Meeting, the proxy holders named on the Company’s proxy card will vote your shares in accordance with their best judgment.

Information About This Proxy Statement

Why you received this Proxy Statement. You have received these proxy materials because the Company’s Board is soliciting your proxy to vote your shares at the Special Meeting. This Proxy Statement includes information that we are required to provide to you under the rules of the Securities and Exchange Commission (“SEC”) and that is designed to assist you in voting your shares.

Voting Instructions. Instructions regarding how you can vote are contained on the proxy card or on the instructions that accompanied your proxy materials.

Householding. The SEC’s rules permit us to deliver a single set of proxy materials to one address shared by two or more of our stockholders. This delivery method is referred to as “householding” and can result in significant cost savings. To take advantage of this opportunity, we have delivered only one set of proxy materials to multiple stockholders who share an address, unless we received contrary instructions from the impacted stockholders prior to the mailing date. We agree to deliver promptly, upon written or oral request, a separate copy of the proxy materials, as requested, to any stockholder at the shared address to which a single copy of those documents was delivered. If you prefer to receive separate copies of the proxy materials, contact Broadridge Financial Solutions, Inc. (“Broadridge”) at 1-866-540-7095 or in writing at Broadridge, Householding Department, 51 Mercedes Way, Edgewood, New York 11717.

If you are currently a stockholder sharing an address with another stockholder and wish to receive only one copy of future proxy materials for your household, please contact Broadridge at the above phone number or address.

QUESTIONS AND ANSWERS ABOUT THE SPECIAL MEETING OF STOCKHOLDERS

Who is entitled to vote at the Special Meeting?

The Record Date for the Special Meeting is May 1, 2023. You are entitled to vote at the Special Meeting only if you were a stockholder of record of Class A Common Stock or Class X Common Stock at the close of business on that date (and additionally the stockholder of record of Series A Preferred Stock at the close of business on that date is entitled to vote together with such stockholders of record of Class A Common Stock and Class X Common Stock on Proposal 2 at the Special Meeting), or if you hold a valid proxy for the Special Meeting. Each outstanding share of our Class A Common Stock is entitled to one vote and each outstanding share of our Class X Common Stock is entitled to 20 votes on all matters presented at the Special Meeting. The holders of Class A Common Stock and Class X Common Stock will vote together as a single class on all matters presented to stockholders at the Special Meeting. At the close of business on the Record Date, there were 288,959,266 shares of Class A Common Stock, which includes the Restricted Earnout Shares as well as restricted shares of Class A

Common Stock issued upon early exercises of options, and 34,534,930 shares of Class X Common Stock outstanding and entitled to vote at the Special Meeting, representing approximately 29.5% and 70.6% of the total voting power of our Common Stock, respectively. At the close of business on the Record Date, there was one share of Series A Preferred Stock outstanding. The holder of record of our Series A Preferred Stock as of the Record Date is not entitled to notice of or to vote on Proposal 1, but is entitled to notice of and to vote together with the holders of Class A Common Stock and Class X Common Stock on Proposal 2 at the Special Meeting.

What is the difference between being a “record holder” and holding shares in “street name”?

A record holder holds shares in his or her name. Shares held in “street name” means shares that are held in the name of a bank or broker on a person’s behalf.

Am I entitled to vote if my shares are held in “street name”?

Yes. If your shares are held by a bank or a broker, you are considered the “beneficial owner” of those shares held in “street name.” If your shares are held in street name, these proxy materials are being provided to you by your bank or broker, along with a voting instruction card. As the beneficial owner, you have the right to direct your bank or broker how to vote your shares, and the bank or broker is required to vote your shares in accordance with your instructions. If your shares are held in “street name” and you would like to vote your shares online at the Special Meeting, you should contact your bank or broker to obtain your 16-digit control number or otherwise vote through the bank or broker.

How many shares must be present to hold the Special Meeting?

A quorum must be present at the Special Meeting for any business to be conducted. The presence at the Special Meeting online or by proxy, of the holders of a majority in voting power of the Common Stock issued and outstanding and entitled to vote on the Record Date will constitute a quorum.

Who can attend the Special Meeting?

You may attend the Special Meeting online only if you are a Bird stockholder who is entitled to vote at the Special Meeting, or if you hold a valid proxy for the Special Meeting. You may attend and participate in the Special Meeting by visiting the following website: www.virtualshareholdermeeting.com/BRDS2023. To attend and participate in the Special Meeting, you will need the 16-digit control number included on your proxy card or on the instructions that accompanied your proxy materials. If your shares are held in “street name,” you should contact your bank or broker to obtain your 16-digit control number or otherwise vote through the bank or broker. If you lose your 16-digit control number, you may join the Special Meeting as a “Guest” but you will not be able to vote, ask questions or access the list of stockholders as of the Record Date. The meeting webcast will begin promptly at 1:00 p.m., Eastern Time. We encourage you to access the meeting prior to the start time. Online check-in will begin at 12:45 p.m. Eastern Time, and you should allow ample time for the check-in procedures.

What if a quorum is not present at the Special Meeting?

If a quorum is not present at the scheduled time of the Special Meeting, the Chair of the Special Meeting is authorized by our Amended and Restated Bylaws to adjourn the meeting, without the vote of stockholders.

What does it mean if I receive more than one set of proxy materials?

It means that your shares are held in more than one account at the transfer agent and/or with banks or brokers. Please vote all of your shares. To ensure that all of your shares are voted, for each set of proxy materials, please submit your proxy by phone, via the Internet, or by signing, dating and returning the enclosed proxy card in the enclosed return envelope.

How do I vote?

Stockholders of Record. If you are a stockholder of record, you may vote:

•by Internet – You can vote over the Internet at www.virtualshareholdermeeting.com/BRDS2023SM by following the instructions on the proxy card or on the instructions that accompanied your proxy materials;

•by Telephone – You can vote by telephone by calling 1-800-690-6903 and following the instructions on the proxy card;

•by Mail – You can vote by mail by signing, dating and mailing the proxy card; or

•Electronically at the Special Meeting – If you attend the meeting online, you will need the 16-digit control number included on your proxy card or on the instructions that accompanied your proxy materials to vote electronically during the meeting.

Internet and telephone voting facilities for stockholders of record will be available 24 hours a day and will close at 11:59 p.m., Eastern Time, on May 17, 2023. To participate in the Special Meeting, including to vote via the Internet or telephone, you will need the 16-digit control number included on your proxy card or on the instructions that accompanied your proxy materials.

Whether or not you expect to attend the Special Meeting online, we urge you to vote your shares as promptly as possible to ensure your representation and the presence of a quorum at the Special Meeting. If you submit your proxy, you may still decide to attend the Special Meeting and vote your shares electronically.

Beneficial Owners of Shares Held in “Street Name.” If your shares are held in “street name” through a bank or broker, you will receive instructions on how to vote from the bank or broker. You must follow their instructions in order for your shares to be voted. Internet and telephone voting also may be offered to stockholders owning shares through certain banks and brokers. If your shares are not registered in your own name and you would like to vote your shares online at the Special Meeting, you should contact your bank or broker to obtain your 16-digit control number or otherwise vote through the bank or broker. If you lose your 16-digit control number, you may join the Special Meeting as a “Guest” but you will not be able to vote, ask questions or access the list of stockholders as of the Record Date. You will need to obtain your own Internet access if you choose to attend the Special Meeting online and/or vote over the Internet.

Can I change my vote after I submit my proxy?

Yes. If you are a registered stockholder, you may revoke your proxy and change your vote:

•by submitting a duly executed proxy bearing a later date;

•by granting a subsequent proxy through the Internet or telephone;

•by giving written notice of revocation to the Secretary of Bird prior to or at the Special Meeting; or

•by voting online at the Special Meeting.

Your most recent proxy card or Internet or telephone proxy is the one that is counted. Your attendance at the Special Meeting by itself will not revoke your proxy unless you give written notice of revocation to our Secretary before your proxy is voted, or you vote online at the Special Meeting.

If your shares are held in street name, you may change or revoke your voting instructions by following the specific directions provided to you by your bank or broker, or you may vote online at the Special Meeting by obtaining your 16-digit control number or otherwise voting through the bank or broker.

Who will count the votes?

A representative of Broadridge, our inspector of election, will tabulate and certify the votes.

What if I do not specify how my shares are to be voted?

If you submit a proxy but do not indicate any voting instructions, the persons named as proxies will vote in accordance with the recommendations of the Board. The Board’s recommendations are indicated on page 3 of this Proxy Statement, as well as with the description of each proposal in this Proxy Statement.

Will any other business be conducted at the Special Meeting?

We know of no other business to be presented at the Special Meeting. If any other matter properly comes before the stockholders for a vote at the Special Meeting, however, the proxy holders named on the Company’s proxy card will vote your shares in accordance with their best judgment.

Why hold a virtual meeting?

A virtual meeting enables increased stockholder attendance and participation because stockholders can participate from any location around the world. You will be able to attend the Special Meeting online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/BRDS2023. You also will be able to vote your shares electronically at the Special Meeting by following the instructions above.

What if during the check-in time or during the Special Meeting I have technical difficulties or trouble accessing the virtual meeting website?

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting website, and the information for assistance will be located on www.virtualshareholdermeeting.com/BRDS2023.

How many votes are required for the approval of the proposals to be voted upon and how will abstentions and broker non-votes be treated?

| | | | | | | | |

| Proposal | Votes required | Effect of Abstentions and Broker

Non-Votes |

Proposal 1: To grant our Board of Directors the authority to exercise its discretion to amend our Certificate of Incorporation to effect a reverse stock split of our outstanding shares of Class A common stock and Class X common stock, each having a par value of $0.0001 per share, to regain compliance with The New York Stock Exchange's $1.00 price requirement, each at any of the following exchange ratios at any time within one year after stockholder approval is obtained, and once approved by the stockholders, the timing of the amendment and the specific reverse split ratio to be effected shall be determined in the sole discretion of our Board of Directors:

A. A one-for-ten reverse stock split;

B. A one-for-fifteen reverse stock split;

C. A one-for-twenty reverse stock split;

D. A one-for-twenty-five reverse stock split;

E. A one-for-thirty reverse stock split;

F. A one-for-thirty-five reverse stock split; or

G. A one-for-forty reverse stock split.

| The affirmative vote of a majority of the outstanding shares of Common Stock entitled to vote, voting together as a single class. | Both abstentions and broker non-votes have the effect of a vote against the proposal. |

| Proposal 2: To grant our Board of Directors the authority to exercise its discretion at any time within one year after stockholder approval is obtained to amend our Certificate of Incorporation to reduce the number of authorized shares of our capital stock, Class A Common Stock, Class B Common Stock, Class X Common Stock, and Preferred Stock (but not the authorized shares of Series A Preferred Stock), in each case, by a corresponding ratio to the reverse stock split if, and only if, the reverse stock split proposal is approved and implemented. | The affirmative vote of a majority of the outstanding shares of capital stock entitled to vote, voting together as a single class. | Both abstentions and broker non-votes have the effect of a vote against the proposal. |

What is an “abstention” and how will abstentions be treated?

An “abstention” represents a stockholder’s affirmative choice to decline to vote on a proposal. Abstentions are counted as present and entitled to vote for purposes of determining a quorum and have the same effect as a vote against the proposal.

What are broker non-votes and do they count for determining a quorum?

Generally, broker non-votes occur when shares held by a broker in “street name” for a beneficial owner are not voted with respect to a particular proposal because the broker (1) has not received voting instructions from the beneficial owner and (2) lacks discretionary voting power to vote those shares. A broker is entitled to vote shares held for a beneficial owner on routine matters without instructions from the beneficial owner of those shares. On the

other hand, absent instructions from the beneficial owner of such shares, a broker is not entitled to vote shares held for a beneficial owner on non-routine matters. Broker non-votes count for purposes of determining whether a quorum is present. With respect to Proposals 1 and 2, broker non-votes have the same effect as a vote against the proposal.

Where can I find the voting results of the Special Meeting?

We plan to announce preliminary voting results at the Special Meeting and we will report the final results in a Current Report on Form 8-K, which we intend to file with the SEC after the Special Meeting.

PROPOSALS TO BE VOTED ON

PROPOSAL 1: TO APPROVE GRANTING OUR BOARD OF DIRECTORS THE AUTHORITY TO EXERCISE ITS DISCRETION TO AMEND OUR CERTIFICATE OF INCORPORATION TO EFFECT A REVERSE STOCK SPLIT OF OUR OUTSTANDING SHARES OF CLASS A COMMON STOCK AND CLASS X COMMON STOCK, EACH HAVING A PAR VALUE OF $0.0001 PER SHARE, TO REGAIN COMPLIANCE WITH THE NEW YORK STOCK EXCHANGE'S $1.00 PRICE REQUIREMENT, EACH AT ANY OF THE FOLLOWING EXCHANGE RATIOS AT ANY TIME WITHIN ONE YEAR AFTER STOCKHOLDER APPROVAL IS OBTAINED, AND ONCE APPROVED BY THE STOCKHOLDERS, THE TIMING OF THE AMENDMENT AND THE SPECIFIC REVERSE SPLIT RATIO TO BE EFFECTED SHALL BE DETERMINED IN THE SOLE DISCRETION OF OUR BOARD OF DIRECTORS: (A) A ONE-FOR-TEN REVERSE STOCK SPLIT; (B) A ONE-FOR-FIFTEEN REVERSE STOCK SPLIT; (C) A ONE-FOR-TWENTY REVERSE STOCK SPLIT; (D) A ONE-FOR-TWENTY-FIVE REVERSE STOCK SPLIT; (E) A ONE-FOR-THIRTY REVERSE STOCK SPLIT; (F) A ONE-FOR-THIRTY-FIVE REVERSE STOCK SPLIT; OR (G) A ONE-FOR-FORTY REVERSE STOCK SPLIT

Our Board believes it is advisable and in the best interests of the Company and our stockholders to approve granting our Board the authority to exercise its discretion to amend our Certificate of Incorporation to effect a reverse stock split of our outstanding shares of Class A Common Stock and Class X Common Stock, each having a par value of $0.0001 per share, and to reduce the number of authorized shares of the Company's capital stock, Class A Common Stock, Class B Common Stock, Class X Common Stock, and Preferred Stock (but not the authorized shares of Series A Preferred Stock), in each case, by a corresponding ratio, to regain compliance with The New York Stock Exchange's $1.00 price requirement, at any of the following exchange ratios at any time within one year after stockholder approval is obtained, and once approved by the stockholders, the timing of the amendment and the specific reverse split ratio to be effected shall be determined in the sole discretion of our Board: (A) a one-for-ten reverse stock split; (B) a one-for-fifteen reverse stock split; (C) a one-for-twenty reverse stock split; (D) a one-for-twenty-five reverse stock split; (E) a one-for-thirty reverse stock split; (F) a one-for-thirty-five reverse stock split or (G) a one-for-forty reverse stock split. On April 19, 2023, our Board approved of the proposed amendment of our Certificate of Incorporation, subject to stockholder approval, that would effect a reverse stock split in which each ten, fifteen, twenty, twenty-five. thirty, thirty-five or forty issued and outstanding shares of each of our Class A Common Stock,and Class X Common Stock would be combined and converted into one share, respectively. Although stockholders are being asked to vote on each of the proposed reverse stock split exchange ratios, only one such proposal will be effected. Pending stockholder approval, our Board will have the sole discretion pursuant to Section 242(c) of the Delaware General Corporation Law to elect, as it determines to be in the best interests of the Company and our stockholders, whether or not to effect a reverse stock split, and if so, the specific number of shares of our Class A Common Stock and Class X Common Stock between and including ten and forty which will be combined into one share, respectively, at any time before the first anniversary of this Special Meeting. The Board believes that stockholder approval of an amendment at each of the proposed reverse stock split ratios granting it the discretion to approve the specific ratio to be effected, rather than approval of only one exchange ratio at this time, provides the Board with maximum flexibility to react to then-current market conditions and, therefore, is in the best interests the Company and our stockholders.

The full text of the form of proposed amendment of the Certificate of Incorporation is attached to this proxy statement as Annex A. By approving this Proposal, stockholders will be approving granting our Board the authority to exercise its discretion to amend our Certificate of Incorporation pursuant to which any whole number of outstanding shares of each of our Class A Common Stock and Class X Common Stock between and including ten and forty would be combined into one share, respectively, and authorizing the Board to file only one such amendment, as determined by the Board in the manner described herein. The Board at its discretion may also elect not to implement any reverse stock split.

If approved by stockholders and following such approval our Board determines that effecting a reverse stock split is in the best interests of the Company and our stockholders, the reverse stock split will become effective upon filing one such amendment with the Secretary of State of the State of Delaware. The amendment filed thereby

will contain the number of shares of each of our Class A Common Stock and Class X Common Stock approved by the stockholders and selected by the Board within the limits set forth in this Proposal to be combined into one share, respectively. Only one such amendment will be filed, if at all, and the other amendments will be abandoned in accordance with Section 242(c) of the Delaware General Corporation Law.

Although we presently intend to effect the reverse stock split to regain compliance with The New York Stock Exchange's $1.00 price requirement, under Section 242(c) of the Delaware General Corporation Law, our Board has reserved the right, notwithstanding stockholder approval of the proposed amendment of the Certificate of Incorporation at the Special Meeting, to abandon it at any time without further action by the stockholders before the amendment of the Certificate of Incorporation is filed with the Secretary of State of the State of Delaware. The Board may consider a variety of factors in determining whether or not to proceed with the proposed amendment of the Certificate of Incorporation, including overall trends in the stock market, recent changes and anticipated trends in the per share market price of our Common Stock on The New York Stock Exchange, business developments, and our actual and projected financial performance. If on the last trading day of any calendar month our Common Stock has a closing share price on The New York Stock Exchange of at least $1.00 and an average closing share price of at least $1.00 over the 30 trading-day period ending on the last trading day of that month, as discussed more fully below, our Board may decide to abandon the filing of the proposed amendment of the Certificate of Incorporation. If the Board fails to implement a reverse stock split prior to the one-year anniversary of the Special Meeting, stockholder approval again would be required prior to implementing any reverse stock split.

Background and Reasons for the Reverse Stock Split

Our primary objective in effectuating the reverse stock split would be to attempt to raise the per share trading price of our Common Stock in an effort to continue our listing on The New York Stock Exchange. To maintain listing, The New York Stock Exchange requires, among other things, that our Common Stock maintain a minimum price of $1.00 per share.

Our Board is seeking approval for the authority to effectuate the reverse stock split as a means of increasing the share price of our Common Stock at or above $1.00 per share in order to avoid delisting by The New York Stock Exchange. We expect that the reverse stock split will increase the price per share of our Common Stock above the $1.00 per share minimum price, thereby satisfying this listing requirement. However, there can be no assurance that the reverse stock split will have that effect, initially or in the future, or that it will enable us to maintain the listing of our Common Stock on The New York Stock Exchange.

In addition, we believe that the low per share market price of our Common Stock impairs its marketability to and acceptance by institutional investors and other members of the investing public and creates a negative impression of the Company. Theoretically, decreasing the number of shares of Common Stock outstanding should not, by itself, affect the marketability of the shares, the type of investor who would be interested in acquiring them, or our reputation in the financial community. In practice, however, many investors, brokerage firms and market makers consider low-priced stocks as unduly speculative in nature and, as a matter of policy, avoid investment and trading in such stocks. Moreover, the analysts at many brokerage firms do not monitor the trading activity or otherwise provide coverage of lower priced stocks. The presence of these factors may be adversely affecting, and may continue to adversely affect, not only the pricing of our Common Stock but also its trading liquidity. In addition, these factors may affect our ability to raise additional capital through the sale of stock.

We further believe that a higher stock price could help us attract and retain employees and other service providers. We believe that some potential employees and service providers are less likely to work for a company with a low stock price, regardless of the size of the company's market capitalization. If the reverse stock split successfully increases the per share price of our Common Stock, we believe this increase will enhance our ability to attract and retain employees and service providers.

We hope that the decrease in the number of shares of our outstanding Common Stock as a consequence of the reverse stock split, and the anticipated increase in the price per share, will encourage greater interest in our Common Stock by the financial community and the investing public, help us attract and retain employees and other service providers, help us raise additional capital through the sale of stock in the future if needed, and possibly promote greater liquidity for our stockholders with respect to those shares presently held by them. However, the possibility also exists that liquidity may be adversely affected by the reduced number of shares which would be outstanding if the reverse stock split is effected, particularly if the price per share of our Common Stock begins a declining trend after the reverse stock split is effected.

There can be no assurance that the reverse stock split will achieve any of the desired results. There also can be no assurance that the price per share of our Common Stock immediately after the reverse stock split will increase proportionately with the reverse stock split, or that any increase will be sustained for any period of time.

If stockholders do not approve this Proposal and our average closing share price does not otherwise increase to greater than $1.00 per share over a 30 trading-day period, we expect our Common Stock to be delisted from The New York Stock Exchange. We believe the reverse stock split is the most likely way to assist the stock price in reaching the $1.00 minimum price level required by The New York Stock Exchange, although effecting the reverse stock split cannot guarantee that we will be in compliance with the $1.00 minimum price requirement even for the minimum 30-day trading period required by The New York Stock Exchange. Furthermore, the reverse stock split cannot guarantee we will maintain compliance with other continued listing criteria required by The New York Stock Exchange.

If our Common Stock were delisted from The New York Stock Exchange, trading of our Common Stock would thereafter be conducted on the OTC Bulletin Board or the "pink sheets". As a result, an investor may find it more difficult to dispose of, or to obtain accurate quotations as to the price of, our Common Stock. To relist shares of our Common Stock on The New York Stock Exchange, we would be required to meet the initial listing requirements, which are more stringent than the maintenance requirements.

In addition, if our Common Stock were delisted from The New York Stock Exchange and the price of our Common Stock were below $5.00 at such time, such stock would come within the definition of "penny stock" as defined in the Securities Exchange Act of 1934, as amended and would be covered by Rule 15g-9 of the Securities Exchange Act of 1934. That rule imposes additional sales practice requirements on broker-dealers who sell such securities to persons other than established customers and accredited investors (generally institutions with assets in excess of $5 million or individuals with net worth in excess of $1 million or annual income exceeding $200,000 or $300,000 jointly with their spouse). For transactions covered by Rule 15g-9, the broker-dealer must make a special suitability determination for the purchaser and receive the purchaser's written agreement to the transaction prior to the sale. These additional sales practice restrictions will make trading in our Common Stock more difficult and the market less efficient.

We are not aware of any present efforts by anyone to accumulate our Common Stock, and the proposed reverse stock split is not intended to be an anti-takeover device.

The Reverse Stock Split May Not Result in an Increase in the Per Share Price of Our Common Stock; There Are Other Risks Associated with the Reverse Stock Split

We cannot predict whether the reverse stock split will increase the market price for our Common Stock. The history of similar stock split combinations for companies in like circumstances is varied. There is no assurance that:

•the market price per share will either exceed or remain in excess of the $1.00 minimum price as required by The New York Stock Exchange;

•we will otherwise continue to meet the requirements of The New York Stock Exchange for continued listing;

•the market price per share after the reverse stock split will rise in proportion to the reduction in the number of shares outstanding before the reverse stock split;

•the reverse stock split will result in a per share price that will attract brokers and investors who do not trade in lower priced stocks; or

•the reverse stock split will result in a per share price that will increase our ability to attract and retain employees and other service providers.

If the reverse stock split is effected and the market price of our Common Stock declines, the percentage decline as an absolute number and as a percentage of our overall market capitalization may be greater than would occur in the absence of a reverse stock split. In some cases, the total market value of a company following a reverse stock split is lower, and may be substantially lower, than the total market value before the reverse stock split. In addition, the fewer number of shares that will be available to trade could possibly cause the trading market of our Common Stock to become less liquid, which could have an adverse effect on the price of our Common Stock. The market price of our Common Stock is based on our performance and other factors, including trading dynamics and substantial volatility, which are likely unrelated to the number of our shares outstanding. In addition, there can be no assurance that the reverse stock split will result in a per share price that will attract brokers and investors who do not trade in lower priced stock.

Principal Effects of Reverse Stock Split on Market for Common Stock

On May 1, 2023, the closing price for our Common Stock on The New York Stock Exchange was $0.15 per share. By decreasing the number of shares of Common Stock outstanding without altering the aggregate economic interest represented by the shares, we believe the market price will be increased. The greater the market price rises above $1.00 per share, the less risk there will be that we will fail to meet the requirements for maintaining the listing of our Common Stock on The New York Stock Exchange. However, there can be no assurance that the market price of the Common Stock will rise to or maintain any particular level or that we will at all times be able to meet the requirements for maintaining the listing of our Common Stock on The New York Stock Exchange.

Principal Effects of Reverse Stock Split on Common Stock and Preferred Stock; No Fractional Shares

If stockholders approve granting the Board the authority to exercise its discretion to amend our Certificate of Incorporation to effect a reverse stock split, and if the Board decides to effectuate such amendment and reverse stock split, the principal effect of the reverse stock split will be to reduce the number of issued and outstanding shares of each of our Class A Common Stock and Class X Common Stock, in accordance with an exchange ratio approved by the stockholders and determined by the Board as set forth in this Proposal, from approximately 288,959,266 shares of Class A Common Stock to between and including approximately 28,959,267 and 7,223,982 shares, and from approximately 34,534,930 shares of Class X Common Stock to between and including approximately 3,453,493 and 863,373 shares, in each case depending on which reverse stock ratio is effectuated by the Board and based upon the number of shares outstanding at the time such reverse stock split is effectuated. The reverse stock split will not affect the Series A Preferred Stock because the Series A Preferred Stock is not convertible into any other securities of the Company and because the outstanding share of Series A Preferred Stock is not being combined and converted into a lesser number of shares. The total number of shares of Common Stock each stockholder holds will be reclassified automatically into the number of shares of Common Stock equal to the number of shares of Common Stock each stockholder held immediately before the reverse stock split divided by the exchange ratio approved by the stockholders and determined by the Board as set forth in this Proposal.

If the number of shares of Common Stock a stockholder holds is not evenly divisible by such exchange ratio, that stockholder will not receive a fractional share but instead will receive one whole share of Common Stock in lieu of such fractional share.

The reverse stock split will affect all of our holders of Common Stock uniformly and will not affect any stockholder's percentage ownership interests, except to the extent that the reverse stock split results in any stockholders owning a fractional share. As described above, stockholders holding a fractional share will be entitled to one whole share in lieu of such fractional share. Common stock issued pursuant to the reverse stock split will remain fully paid and non-assessable. The par value of our Common Stock and Preferred Stock would remain unchanged at $0.0001 per share. We will continue to be subject to the periodic reporting requirements of the Securities Exchange Act of 1934.

Principal Effects of Reverse Stock Split on Outstanding Restricted Shares, Options, Warrants and Convertible Senior Secured Notes

As of the Record Date, there were 2,072,666 Restricted Earnout Shares and 300,00 Restricted Management Shares under the 2021 Plan, as well as restricted shares of Class A Common Stock issued upon early exercises of options. The reverse stock split will have the same effect on these shares as the other shares of Class A Common Stock.

As of the Record Date, we had outstanding (i) stock options to purchase an aggregate of 11,790,000 shares of Class A Common Stock with a weighted average exercise price of $0.2921 per share, (ii) private placement warrants to purchase an aggregate of 6,550,000 shares of Class A Common Stock at an exercise price of $11.50 per share, subject to certain redemption rights, (iii) private placement warrants to purchase an aggregate of 59,908 shares of Class A Common Stock at an exercise price of $13.36 per share, (iv) public warrants to purchase an aggregate of 6,324,972 shares of Class A Common Stock at an exercise price of $11.50 per share, and (v) convertible senior secured notes convertible into shares of Class A Common Stock at any time at a conversion rate of approximately 3,473 shares of Class A Common Stock per $1,000 principal amount of the notes, equivalent to a conversion price of approximately $0.2879 per share, subject to specified anti-dilution adjustments and adjustments for certain corporate events. When the reverse stock split becomes effective, the number of shares of Class A Common Stock covered by each of the foregoing securities will be reduced to between and including one-tenth and one-thirtieth the number currently covered and the exercise or conversion price per share (and any earnout triggering event price per share) will be increased by between and including ten and forty times the current exercise or conversion price, resulting in the same aggregate price being required to be paid therefor upon exercise or conversion thereof as was required immediately preceding the reverse stock split.

Principal Effects of Reverse Stock Split on Equity Incentive Plans

As of the Record Date, we had 63,231,929 shares of Class A Common Stock reserved under the 2021 Plan. Pursuant to the terms of the 2021 Plan, the Compensation Committee of the] Board will reduce the number of shares of Class A Common Stock reserved under the 2021 Plan to between and including one-tenth and one-thirtieth of the number of shares currently included in such plan. Furthermore, the number of shares available for future grant under the 2021 Plan will be similarly adjusted.

Principal Effects of Reverse Stock Split on Legal Ability to Pay Dividends

Our Board has not in the past declared, nor does it have any plans to declare in the foreseeable future, any distributions of cash, dividends or other property, and we are not in arrears on any dividends. Therefore, we do not believe that the reverse stock split will have any effect with respect to future distributions, if any, to our holders of Common Stock.

Accounting Matters

The reverse stock split will not affect the par value of our Common Stock, which will remain unchanged at $0.0001 per share, or the number of authorized shares of Common Stock. As a result, on the effective date of the reverse stock split, the stated capital on our balance sheet attributable to our Common Stock, which consists of the par value per share of our Common Stock multiplied by the aggregate number of shares of our Common Stock issued and outstanding, will be reduced by a factor of between and including ten and forty. In other words, stated capital will be reduced to between and including one-tenth and one-fortieth of its present amount, and the additional paid-in capital account, which consists of the difference between the stated capital and the aggregate amount paid upon issuance of all currently outstanding shares of Common Stock, will be credited with the amount by which the stated capital is reduced. The stockholders’ equity, in the aggregate, will remain unchanged. In addition, the per share net income or loss and net book value of our Common Stock will be increased because there will be fewer shares of Common Stock outstanding in both the basic and fully diluted calculations.

Potential Anti-Takeover Effect

The increased proportion of unissued authorized shares to issued shares could, under certain circumstances, be construed as having an anti-takeover effect (for example, by permitting issuances that would dilute the stock ownership of a person seeking to effect a change in the composition of our Board or contemplating a tender offer or other transaction for the combination of the Company with another company). Although not designed or intended for such purposes, the effect of the proposed reverse stock split might be to render more difficult or to discourage a merger, tender offer, proxy contest or change in control of the Company and the removal of management, which stockholders might otherwise deem favorable. For example, the authority of our Board to issue Common Stock might be used to create voting impediments or to frustrate an attempt by another person or entity to effect a takeover or otherwise gain control of us because the issuance of additional common stock would dilute the voting power of the common stock and preferred stock then outstanding. Our Common Stock could also be issued to purchasers who would support our Board in opposing a takeover bid, which our Board determines not to be in the best interests of the Company and our stockholders. Our Board is not presently aware of any attempt, or contemplated attempt, to acquire control of the Company and the reverse stock split proposal is not part of any plan by our Board to recommend or implement a series of anti-takeover measures.

Procedure for Effecting Reverse Stock Split; Exchange of Stock Certificates; Treatment of Fractional Shares

If stockholders approve granting our Board the authority to exercise its discretion to effectuate the reverse stock split and if our Board determines to effectuate the reverse stock split, we will file the proposed amendment to the Certificate of Incorporation with the Secretary of State of the State of Delaware. The reverse stock split will become effective at the time specified in the amendment, which will most likely be the date of the filing of the amendment and which we refer to as the "effective time." Beginning at the effective time, each certificate representing outstanding pre-reverse stock split shares of Common Stock will be deemed for all corporate purposes to evidence ownership of post-reverse stock split shares of Common Stock.

We will appoint Continental Stock Transfer & Trust Company, 1 State St., 20th Floor, New York, NY 10004, 212-509-4000, to act as exchange agent for holders of Common Stock in connection with the reverse stock split. Neither the Company nor Continental Stock Transfer & Trust Company will distribute fractional shares of Common Stock. As described above, stockholders holding a fractional share will be entitled to one whole share in lieu of such fractional share. Our stockholder list shows that some of our outstanding Common Stock is registered in the names of clearing agencies and broker nominees. Because we do not know the numbers of shares held by each

beneficial owner for whom the clearing agencies and broker nominees are record holders, we cannot predict with certainty the number of fractional shares that will result from the reverse stock split or the total amount of shares we will be required to issue in lieu of fractional shares. However, we do not expect that amount will be material.

As of the Record Date, we had approximately 288,959,266 holders of record of Class A Common Stock (although we had significantly more beneficial holders), no holders of record of Class B Common Stock and 34,534,930 holders of record of Class X Common Stock. We do not expect the reverse stock split to result in a significant reduction in the number of record holders. We presently do not intend to seek any change in our status as a reporting company for federal securities law purposes, either before or after the reverse stock split.

Effect on Beneficial Holders of Common Stock (i.e., stockholders who hold in “street name”): Upon the effectiveness of the reverse stock split, we intend to treat shares of Common Stock held by stockholders in “street name,” through a bank, broker or other nominee, in the same manner as registered stockholders whose shares of Common Stock are registered in their names. Banks, brokers or other nominees will be instructed to effect the reverse stock split for their beneficial holders holding the Common Stock in “street name.” However, these banks, brokers or other nominees may have different procedures than registered stockholders for processing the reverse stock split. If a stockholder holds shares of Common Stock with a bank, broker or other nominee and has any questions in this regard, stockholders are encouraged to contact their bank, broker or other nominee.

Effect on Registered “Book-Entry” Holders of Common Stock (i.e., stockholders that are registered on the transfer agent’s books and records): All of our registered holders of Common Stock hold their shares electronically in book-entry form with our transfer agent. They are provided with a statement reflecting the number of shares registered in their accounts.

If a stockholder holds registered shares in book-entry form with the transfer agent, no action needs to be taken to receive post-reverse stock split shares. If a stockholder is entitled to post-reverse stock split shares, a transaction statement will automatically be sent to the stockholder’s address of record indicating the number of shares of Common Stock held following the reverse stock split.

Stockholders will not have to pay any service charges in connection with the exchange of their certificates.

Even if stockholders approve the reverse stock split, our Board reserves the right to not effect the reverse stock split if in our Board's opinion it would not be in the best interests of the Company or our stockholders to effect such reverse stock split.

No Dissenters' or Appraisal Rights

Under the Delaware General Corporation Law, stockholders are not entitled to any dissenter's or appraisal rights with respect to the reverse stock split, and we will not independently provide stockholders with any such right.

Interest of Certain Persons in Matters to Be Acted Upon

No officer or director has any substantial interest, direct or indirect, by security holdings or otherwise, in the reverse stock split that is not shared by all of our other stockholders.

Material U.S. Federal Income Tax Consequences

The following is a general discussion of the material U.S. federal income tax consequences of the reverse stock split. This discussion does not provide a complete analysis of all potential U.S. federal income tax considerations relating thereto. This description is based on the U.S. Internal Revenue Code of 1986, as amended (the “Code”) and existing and proposed U.S. Treasury regulations promulgated thereunder, administrative pronouncements, judicial decisions, and interpretations of the foregoing, all as of the date hereof and all of which are subject to change, possibly with retroactive effect.

This discussion addresses only Common Stock held as capital assets within the meaning of Section 1221 of the Code (generally for investment) by U.S. holders (defined below).

Moreover, this discussion is for general information only and does not address all of the tax consequences that may be relevant to you in light of your particular circumstances, including the alternative minimum tax, the Medicare tax on certain investment income or any state, local or foreign tax laws or any U.S. federal tax laws other

than U.S. federal income tax laws, nor does it discuss special tax provisions, which may apply to you if you are subject to special treatment under U.S. federal income tax laws, such as for:

•certain financial institutions or financial services entities,

•insurance companies,

•tax-exempt entities,

•tax-qualified retirement plans,

•dealers in securities or currencies,

•entities that are treated as partnerships or other pass-through entities for U.S. federal income tax purposes (and partners or beneficial owners therein),

•foreign branches,

•corporations that accumulate earnings to avoid U.S. federal income tax,

•regulated investment companies,

•real estate investment trusts,

•persons deemed to sell Common Stock under the constructive sale provisions of the Code, and

•persons that hold Common Stock as part of a straddle, hedge, conversion transaction, or other integrated investment.

You are urged to consult your own tax advisor concerning the U.S. federal income tax consequences of the reverse stock split, as well as the application of any state, local, foreign income and other tax laws.

As used in this discussion, a “U.S. holder” is a beneficial owner of Common Stock that is, for U.S. federal income tax purposes:

•an individual who is a citizen or resident of the United States;

•a corporation (or other entity taxable as a corporation for U.S. federal income tax purposes) that is created or organized in or under the laws of the United States, any state thereof or the District of Columbia;

•an estate the income of which is subject to U.S. federal income taxation regardless of its source; or

•a trust if (i) a court within the United States is able to exercise primary supervision over the administration of the trust and one or more U.S. persons have the authority to control all substantial decisions of the trust or (ii) it has a valid election in effect under applicable U.S. Treasury regulations to be treated as a domestic trust.

If a partnership or other entity or arrangement treated as a pass-through entity for U.S. federal income tax purposes is a beneficial owner of Common Stock, the tax treatment of a partner in the partnership or an owner of the other pass-through entity or arrangement generally will depend upon the status of the partner or owner and the activities of the partnership or other pass-through entity or arrangement. Any partnership, partner in such a partnership or owner of another pass-through entity or arrangement holding Common Stock should consult its own tax advisor as to the particular U.S. federal income tax consequences applicable to it.

STOCKHOLDERS ARE URGED TO CONSULT THEIR OWN TAX ADVISORS REGARDING THE APPLICATION OF U.S. FEDERAL INCOME TAX LAWS TO THEIR PARTICULAR SITUATIONS AND THE CONSEQUENCES OF OTHER FEDERAL, STATE, LOCAL AND FOREIGN TAX LAWS, AND APPLICABLE TAX TREATIES, IN PARTICULAR, STOCKHOLDERS WHOSE FRACTIONAL SHARES RESULTING FROM THE REVERSE STOCK SPLIT ARE ROUNDED UP TO THE NEAREST WHOLE SHARE AND WITH RESPECT TO ALLOCATING TAX BASIS AND HOLDING PERIOD AMONG THEIR POST-REVERSE STOCK SPLIT SHARES.

A U.S. holder generally will not recognize gain or loss upon the reverse stock split, except that a U.S. holder whose fractional shares resulting from the reverse stock split are rounded up to the nearest whole share may recognize gain for U.S. federal income tax purposes equal to the value of the additional fractional share. In the aggregate, a U.S. holder’s basis in the Common Stock received upon the reverse stock split generally will equal the basis of the U.S. holder’s surrendered Common Stock, increased by the income or gain attributable to the rounding up of fractional shares, as described herein. New shares attributable to the rounding up of fractional shares to the nearest whole number of shares may be treated for tax purposes as if the fractional shares constitute a disproportionate dividend distribution. Such U.S. holders generally should recognize ordinary income to the extent of earnings and profits of the Company allocated to the portion of each whole share attributable to the rounding up process, and the remainder, if any, may be treated as a return of tax basis and gain received from the exchange of property. The holding period of the Common Stock received upon the reverse stock split generally will include the holding period of the surrendered Common Stock. The portion of the shares received by a U.S. holder that are attributable to rounding up for fractional shares will have a holding period commencing on the effective date of the reverse stock split.

U.S. holders that have acquired different blocks of Common Stock at different times or at different prices are urged to consult their own tax advisors regarding the allocation of their aggregated basis among, and the holding period of, the Common Stock received in the reverse stock split.

THE PRECEDING DISCUSSION OF U.S. FEDERAL INCOME TAX CONSEQUENCES IS FOR GENERAL INFORMATION ONLY. IT IS NOT TAX ADVICE. EACH STOCKHOLDER IS URGED TO CONSULT ITS OWN TAX ADVISOR REGARDING THE PARTICULAR U.S. FEDERAL, STATE, LOCAL AND FOREIGN TAX CONSEQUENCES OF THE REVERSE STOCK SPLIT AND THE CONVERSION, INCLUDING THE CONSEQUENCES OF ANY PROPOSED CHANGE IN APPLICABLE LAWS AND TREATIES, IN PARTICULAR, STOCKHOLDERS WHOSE FRACTIONAL SHARES RESULTING FROM THE REVERSE STOCK SPLIT ARE ROUNDED UP TO THE NEAREST WHOLE SHARE AND WITH RESPECT TO ALLOCATING TAX BASIS AND HOLDING PERIOD AMONG THEIR POST-REVERSE STOCK SPLIT SHARES.

Vote required

The reverse stock split proposal requires the affirmative “FOR” vote of a majority of the outstanding Common Stock capital stock entitled to vote, voting together as a single class. You may vote “FOR,” “AGAINST,” or “ABSTAIN” on this proposal. Abstentions have the same effect as a vote against the proposal.

Recommendation of the Board

| | | | | |

| The Board recommends a vote “FOR” granting the Board the authority to exercise its discretion to amend our Certificate of Incorporation to effect a reverse stock split of our outstanding shares of Class A Common Stock and Class X Common Stock, each having a par value of $0.0001 per share, to regain compliance with The New York Stock Exchange's $1.00 price requirement, at any of the following exchange ratios at any time within one year after stockholder approval is obtained, and once approved by the stockholders, the timing of the amendment and the specific reverse split ratio to be effected shall be determined in the sole discretion of our Board: (A) a one-for-ten reverse stock split; (B) a one-for-fifteen reverse stock split; (C) a one-for-twenty reverse stock split; (D) a one-for-twenty-five reverse stock split; (E) a one-for-thirty reverse stock split; (F) a one-for-thirty-five reverse stock split; or (G) a one-for-forty reverse stock split. |

PROPOSAL 2: TO APPROVE GRANTING OUR BOARD OF DIRECTORS THE AUTHORITY TO EXERCISE ITS DISCRETION AT ANY TIME WITHIN ONE YEAR AFTER STOCKHOLDER APPROVAL IS OBTAINED TO AMEND OUR CERTIFICATE OF INCORPORATION TO REDUCE THE NUMBER OF AUTHORIZED SHARES OF OUR CAPITAL STOCK, CLASS A COMMON STOCK, CLASS B COMMON STOCK, CLASS X COMMON STOCK, AND PREFERRED STOCK (BUT NOT THE AUTHORIZED SHARES OF SERIES A PREFERRED STOCK), IN EACH CASE, BY A CORRESPONDING RATIO TO THE REVERSE STOCK SPLIT IF, AND ONLY IF, THE REVERSE STOCK SPLIT PROPOSAL IS APPROVED AND IMPLEMENTED

Our Board believes it is advisable and in the best interests of the Company and our stockholders to approve granting our Board of Directors the authority to exercise its discretion at any time within one year after stockholder approval is obtained to amend our Certificate of Incorporation to reduce the number of authorized shares of our capital stock, Class A Common Stock, Class B Common Stock, Class X Common Stock, and Preferred Stock (but not the authorized shares of Series A Preferred Stock), in each case, by a corresponding ratio to the reverse stock split if, and only if, the reverse stock split proposal is approved and implemented. On April 19, 2023, our Board approved of the proposed amendment of our Certificate of Incorporation, subject to stockholder approval, that would reduce the number of authorized shares of our capital stock, Class A Common Stock, Class B Common Stock, Class X Common Stock, and Preferred Stock (but not the authorized shares of Series A Preferred Stock), in each case, by a corresponding ratio to the reverse stock split. Although stockholders are being asked to vote on each of the proposed ratios, only the one proposal that corresponds to the approved and implemented reverse stock split ratio would be effected.

The full text of the form of proposed amendment of the Certificate of Incorporation is attached to this proxy statement as Annex A. By approving this Proposal, stockholders will be approving granting our Board the authority to exercise its discretion at any time within one year after stockholder approval is obtained to amend our Certificate

of Incorporation to reduce the number of authorized shares of our capital stock, Class A Common Stock, Class B Common Stock, Class X Common Stock, and Preferred Stock (but not the authorized shares of Series A Preferred Stock), in each case, by a corresponding ratio to the reverse stock split if, and only if, the reverse stock split proposal is approved and implemented.

If approved by stockholders and following such approval our Board determines that effecting a reverse stock split and an authorized shares reduction is in the best interests of the Company and our stockholders, the authorized shares reduction will become effective upon filing one such amendment with the Secretary of State of the State of Delaware. The amendment filed thereby will contain the number of authorized shares of each of our capital stock, Class A Common Stock, Class B Common Stock, Class X Common Stock, and Preferred Stock (but not the authorized shares of Series A Preferred Stock) approved by the stockholders and selected by the Board within the limits set forth in this Proposal, respectively. Only one such amendment will be filed, if at all, and the other amendments will be abandoned in accordance with Section 242(c) of the Delaware General Corporation Law.

The implementation of this Proposal 2 is expressly conditioned upon the approval and implementation of Proposal 1; if Proposal 1 is not approved and implemented, then this Proposal 2 will not be implemented. Accordingly, if we do not receive the required stockholder approval for Proposal 1 or the reverse stock split is not otherwise implemented, then we will not implement the authorized shares reduction. If we receive the required stockholder approval for Proposal 1 but do not receive the required stockholder approval for Proposal 2, then our Board will nonetheless retain the ability to implement the reverse stock split and, if so effected, the total number of authorized shares of our stock would not be reduced. Under Section 242(c) of the Delaware General Corporation Law, our Board has reserved the right, notwithstanding stockholder approval of the proposed amendment of the Certificate of Incorporation at the Special Meeting, to abandon it at any time without further action by the stockholders before the amendment of the Certificate of Incorporation is filed with the Secretary of State of the State of Delaware.

Background and Reasons for the Authorized Shares Reduction

As a matter of Delaware law, the implementation of the reverse stock split does not require a reduction in the total number of authorized shares of our stock. However, if Proposals 1 and 2 are approved by our stockholders and the reverse stock split is implemented, our Board has the discretion to reduce the authorized number of shares of our stock by a corresponding ratio. The reason for the authorized shares reduction is so that we do not have what some stockholders might view as an unreasonably high number of authorized shares of stock that are unissued relative to the number of shares outstanding following the reverse stock split.

Risks Associated with the Authorized Shares Reduction

If both Proposals 1 and 2 are approved and the reverse stock split and authorized shares reduction are implemented, then there will be fewer authorized shares of stock available to issue or reserve for issuance. If we require additional authorized shares in the future, we would be forced to seek and obtain the approval of our stockholders to effect an increase to the authorized shares of stock. Any such increase to the authorized shares would require us to solicit proxies and hold a vote at an annual or special meeting of the stockholders. The stockholder meeting process can be costly and time-consuming and is subject to a variety of SEC rules that implement waiting periods throughout the process, which could prevent us from obtaining any increase to our authorized shares in a timely manner. Moreover, our stockholders may not approve any proposal to increase our authorized shares. Either of these outcomes could force us to forego opportunities that we believe to be valuable or prevent us from using equity for raising capital, strategic transactions, compensation or other corporate purposes, which could limit our flexibility and prospects and strain our cash resources.

If this Proposal 2 is not approved, but Proposal 1 is approved and the reverse stock split is implemented, then the authorized number of shares of our stock would remain unchanged following the reverse stock split. As a result, a reverse stock split, without an authorized shares reduction, will have the effect of increasing the number of authorized but unissued shares of stock available for future issuance, which might be construed as having an anti-takeover effect by permitting the issuance of shares to purchasers who might oppose a hostile takeover bid or oppose any efforts to amend or repeal certain provisions of our Certificate of Incorporation or Bylaws. If the authorized number of shares of our stock remains unchanged following the reverse stock split, some stockholders also might view us as having an unreasonably high number of authorized shares of stock that are unissued relative to the number of shares outstanding following the reverse stock split, the future issuance of which could be more dilutive to stockholders than if the authorized shares had been reduced in connection with the reverse stock split.

In addition, if we implement a reverse stock split but do not change the number of authorized shares of stock, our annual Delaware franchise tax liability could increase substantially, including to the maximum annual tax amount. This potential increase in tax liability is a result of the manner in which the Delaware franchise tax is

calculated: the calculation can depend, in part, on the number of shares of capital stock a corporation is authorized to issue and the number of shares of capital stock a corporation has issued, with the tax liability increasing as the difference between the number of authorized shares and outstanding shares increases.

Principal Effects of the Authorized Shares Reduction

Because the authorized shares reduction is contingent upon the implementation of the reverse stock split, the principal effect of the authorized shares reduction will be that the number of authorized shares of each of our capital stock, Class A Common Stock, Class B Common Stock, Class X Common Stock, and Preferred Stock (but not the authorized shares of Series A Preferred Stock) will be reduced by the same ratio as the reverse stock split. The authorized shares reduction would not have any effect on the rights of existing stockholders, participants in our equity plans, or holders of any of our other equity securities, and the par value of the capital stock, Class A Common Stock, Class B Common Stock, Class X Common Stock, and Preferred Stock would remain unchanged at $0.0001 per share.

Procedure for Effecting the Authorized Shares Reduction

If stockholders approve granting our Board the authority to exercise its discretion to effectuate the authorized shares reduction and if our Board determines to effectuate the authorized shares reduction, we will file the proposed amendment to the Certificate of Incorporation with the Secretary of State of the State of Delaware. The authorized shares reduction will become effective at the time specified in the amendment, which will most likely be the date of the filing of the amendment and which we refer to as the "effective time."

No Dissenters' or Appraisal Rights

Under the Delaware General Corporation Law, stockholders are not entitled to any dissenter's or appraisal rights with respect to the authorized shares reduction, and we will not independently provide stockholders with any such right.

Interest of Certain Persons in Matters to Be Acted Upon

No officer or director has any substantial interest, direct or indirect, by security holdings or otherwise, in the authorized shares reduction that is not shared by all of our other stockholders.

Vote required